Are you considering retiring in the next few years? Here's an updated document from SEBAC outlining the changes in retiree benefits that take effect July 1, 2022.

Additionally, following is an additional resource from SEBAC and AFT CT's Ed Leavey:

SEBAC and the Silver Tsunami

Regardless of whether SEBAC and the State reached an agreement in 2017, 2022 was going to be an enormously important year. The 2017 agreement lessened the impact; had we not reached an agreement, the SEBAC agreement would have expired, and we would have needed to renegotiate all our pension and healthcare benefits. Instead, we will be facing significant but clear changes to our benefits. Our members in SERS who are eligible for retirement may want to start thinking now about what 2022 will mean to them; members in TRS are not affected by the pension changes, but will be affected by the fairly minor retiree healthcare changes:

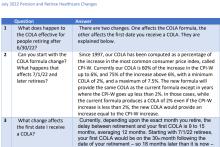

Pension – By far the biggest change is the loss of the 2% minimum cost of living adjustment. Currently, the COLA is based on Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) for the twelve-month period prior to the retiree’s anniversary of retirement. If that amount is under 2% - recently, it has been more often than not – the retiree still receives a 2% “raise.” For anyone retiring after July 1, 2022 that will no longer be true; if the CPI-W rises, for example, 0.4%, the COLA will be 0.4%.

There are other changes as well. COLAs have previously been addressed in July and December; the average length of retirement for State workers to receive their COLA is 18 months. Under SEBAC 2017, everyone will receive their first COLA on their 30-month anniversary of retirement; for most of us, that means an 18-month delay for our first COLA. The other significant change is Medicare Part B. Currently, the State pays 100% of the standard Medicare Part B Premium for all Medicare-covered retirees. The State will continue reimbursing the full standard Medicare Part B Premium but will reduce its reimbursement to half of the additional charges imposed by Medicare beyond the standard premium on high earners. The “high earners” are over $85,000. This change will affect people who retire when they are Medicare-eligible, since half a year’s salary, the sick-time payout, and half a year of pension will likely be more than $85,000; however, a person retiring under the Medicare age is not affected. It also will affect people who have a significant second income. No one in our bargaining unit will have a pension that high.

Retiree Healthcare – Currently, all hazardous duty retirees, and non-hazardous duty with 25 years of service pay 1.5% and other retirees pay 3% of their healthcare plan (as opposed to the 15%-22% active employees pay). For members retiring after July 1, 2022 that moves to 5% for non-hazardous duty, 3% for hazardous duty. For context, a “Retiree + Spouse” plan is currently about $29,000 per year. The difference between 3% and 5% will be about $48 per month. In addition, nothing changes for Medicare-eligible retirees (over 65 or on Social Security Disability) who will continue to pay no premium share for retiree healthcare.

Let’s look at two employees who are over 60 to retire in 2022 and started in 1990. Both make $95,627 per year. One retires in 2022, the other in 2024. For clarity, we will assume that the salary doesn’t change after 2021, so it constitutes best three years. “Year one” means until the one-year anniversary of retirement. Also, we’ll assume 100% retirement (no spousal deduction), and a (very low) 0.4% CPI-W

2022 retirement 2024 retirement

Year one $42,481 $45,518

Year two $43,331 $45,518

Year three $44,197 $45,609

Year four $45,081 $45,791

Year five $45,983 $45,974

Year six $46,902 $46,158

Year seven $47,840 $46,343

This chart comes with two caveats: it assumes that the CPI-W will remain far under 2%; actuaries estimate the average difference between a pre- and post- 2022 retirement will be closer to .05% than 1.6%. More importantly, in the two years between 2022 and 2024 the second person will earn over $105,000 more than the person who retired 2022. It would take decades to make up that difference through the COLA (as Peter Falk says in The In-Laws, not dying is the key to the benefits program). None of this is to say people should not retire in 2022, only that no one should feel they have to retire then. Retirement is an emotional decision as well as a financial one, and that will be true in 2022 as well. There is no need to join the silver tsunami and escape from State service.